Avoir un bassin chez soi est un rêve pour de nombreux propriétaires, mais cela exige un budget bien non négligeable. En effet, entre le prix de la piscine coque, les travaux d’aménagement et l’achat des accessoires, l’investissement peut être conséquent.

Heureusement, plusieurs options de financement sont disponibles. Sélectionner le type de prêt adapté à votre projet de piscine est essentiel pour emprunter en toute tranquillité et en toute connaissance de cause. Suivez le guide !

Quel est le prix d’une piscine coque ?

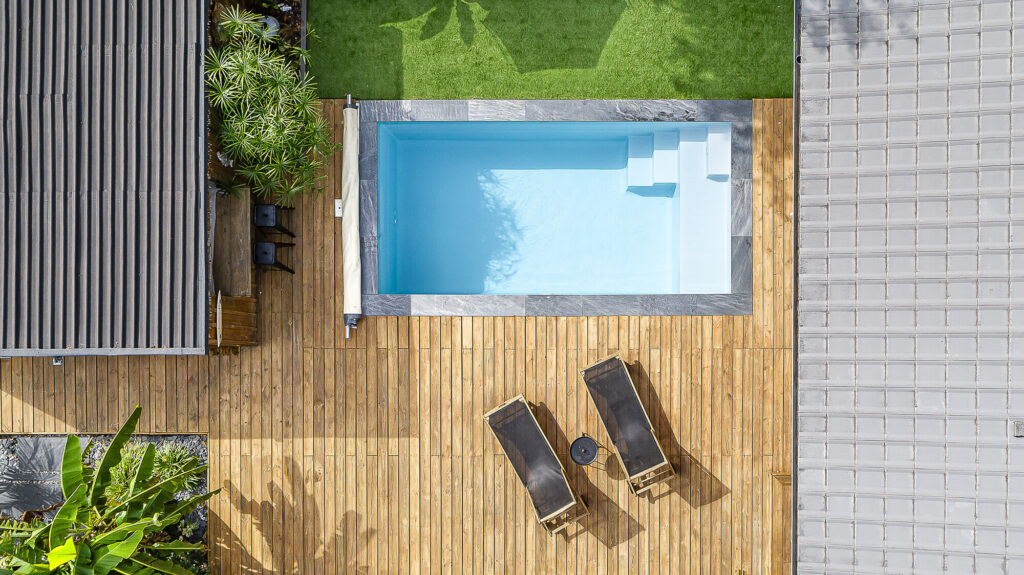

Pour financer votre projet de piscine coque, il est essentiel de bien appréhender les dépenses à prévoir afin d’éviter toute mauvaise surprise. Moins coûteuse qu’une piscine enterrée (ou semi enterrée) en béton et plus attrayante qu’une piscine hors-sol, ce type de piscine reste un investissement significatif, pouvant atteindre plusieurs milliers d’euros.

En règle générale, le coût d’une piscine coque prêt-à-plonger varie en fonction de la taille du bassin, des aménagements extérieurs souhaités, ainsi que des accessoires nécessaires. Chez Aboral Piscines, nos formules varient généralement entre 12 000€ et 35 000€, installation comprise, ce qui en fait une option attrayante pour ceux qui recherchent un projet clé en main avec un budget maîtrisé.

En prenant en compte ces frais dès le début, y compris les travaux de terrassement, vous serez en mesure de définir un budget réaliste et de choisir le financement le plus approprié pour réaliser votre projet en toute tranquillité.

Comment financer son projet de piscine coque ?

Avant d’entamer la construction d’une piscine coque, examinez attentivement les différentes options de financement qui s’offrent à vous. Faire construire une piscine représente un investissement significatif, et choisir le bon type de crédit peut faire toute la différence.

Les différents types de crédit piscine

Le crédit à la consommation

Le prêt personnel (crédit travaux) est une forme de crédit à la consommation qui offre une certaine flexibilité pour financer votre piscine. Il se décline en deux types principaux : le prêt affecté et le prêt personnel non affecté :

- Le prêt affecté est spécifiquement conçu pour financer un projet déterminé, tel que la construction de votre piscine. Dans ce cas, les fonds sont directement liés à la réalisation des travaux, ce qui signifie que des justificatifs comme des devis ou des factures devront être fournis pour débloquer l’argent. L’un des avantages clés de ce crédit est que si votre projet n’aboutit pas, le prêt est annulé, vous évitant ainsi d’avoir à rembourser pour un projet non réalisé.

- Le prêt personnel non affecté, en revanche, vous offre une plus grande liberté d’utilisation des fonds, sans avoir à justifier vos dépenses. Toutefois, cette souplesse implique que le remboursement du prêt commence immédiatement, même si le projet de piscine est retardé ou annulé.

Une autre option, bien que moins adaptée pour un projet de cette envergure, est le crédit renouvelable, également appelé « revolving ». Il s’agit d’une réserve d’argent disponible à tout moment, qui se reconstitue au fur et à mesure des remboursements. Bien que pratique pour des imprévus ou des petites dépenses, ce type de crédit est généralement moins conseillé pour financer une piscine, en raison de ses taux d’intérêt souvent plus élevés.

Peut-on inclure une piscine dans un crédit immobilier ?

Il est possible de financer votre piscine en l’incluant dans votre prêt immobilier, à condition que ce dernier soit souscrit au moment de l’achat de votre bien. Cette approche permet de regrouper l’achat de la propriété et la construction de la piscine en un seul crédit. Toutefois, cela est généralement applicable uniquement aux piscines enterrées ou creusées, car elles sont considérées comme une amélioration permanente, augmentant ainsi la valeur de la propriété.

Pour inclure le coût de la piscine dans votre prêt immobilier, pensez à en discuter avec votre banque dès les premières étapes de la demande de crédit. Cette démarche doit être réalisée avant la finalisation de l’accord de prêt, car une fois que celui-ci est accordé, il n’est plus possible d’ajuster le montant emprunté pour y inclure des travaux additionnels.

Comment construire un dossier solide pour le financement de votre piscine ?

Simulez le financement de votre piscine

Avant de vous lancer dans votre projet de piscine, il est essentiel d’évaluer précisément les fonds nécessaires. Voici les étapes à suivre :

- Évaluez le coût global du projet : Identifiez tous les éléments qui composeront le coût final de votre piscine, incluant l’achat du matériel (bassin, équipements, accessoires), les frais d’installation, et les éventuels travaux d’aménagement du terrain. Une estimation précise vous permettra de déterminer le montant exact à emprunter.

- Analysez votre capacité de remboursement : Examinez votre situation financière pour établir combien vous pouvez consacrer chaque mois au remboursement de votre prêt. Tenez compte de vos revenus, de vos charges actuelles, et de vos autres emprunts en cours. Il est également important de choisir la durée du prêt en fonction du montant des mensualités que vous êtes en mesure de supporter.

- Faîtes une simulation de crédit en ligne : Après avoir déterminé le montant nécessaire et la durée souhaitée, utilisez un simulateur de prêt en ligne pour explorer différentes options. Cela vous permettra de comparer les prêts disponibles, qu’il s’agisse d’un prêt personnel ou d’un prêt affecté aux travaux de piscine. La simulation vous fournira une estimation des mensualités, du coût total du crédit, et du taux d’intérêt applicable.

Comparer les différentes offres de prêt pour piscine

Après avoir réalisé votre simulation, il est temps de comparer les différentes solutions de financement disponibles. Voici les points essentiels à examiner :

- Le TAEG (Taux Annuel Effectif Global) : Le TAEG est l’indicateur principal à considérer lors de la comparaison des offres. Il regroupe tous les coûts liés au crédit, incluant les taux d’intérêt, les frais de dossier, et les assurances. En comparant les TAEG, vous obtenez une vue d’ensemble du coût total de chaque prêt, vous permettant ainsi de faire un choix éclairé.

- Le montant des mensualités et la durée de remboursement : Le montant des mensualités dépend directement de la durée du prêt. Par exemple, pour un prêt de 20 000 € :

- Sur 60 mois (5 ans), la mensualité sera d’environ 350 € ;

- Sur 120 mois (10 ans), elle diminuera à environ 175 € ;

- Sur 180 mois (15 ans), la mensualité pourra être d’environ 120 €.

Comme vous pouvez le constater, une durée de remboursement plus longue réduit les mensualités, mais augmente le coût total du crédit en raison des intérêts accumulés.

- L’assurance emprunteur : Pour les crédits à long terme, l’assurance emprunteur joue un rôle crucial. Elle prend en charge vos remboursements en cas d’incapacité de travail, d’invalidité, ou de décès. Il est essentiel de bien étudier les conditions de cette assurance, car elle offre une protection supplémentaire, particulièrement importante pour les prêts de longue durée.

Envie d’obtenir un devis pour votre projet de piscine ? Contactez directement notre équipe d’experts, elle se fera un plaisir de vous contacter dans les plus brefs délais pour vous proposer une piscine sur mesure qui s’adapte à vos envies et à votre budget !

Configurez votre piscine en ligne Revenir à toute l'actualité